San Antonio title loans offer a flexible and accessible financial solution for residents, empowering them with immediate cash access using vehicle equity. With transparent processes, extended loan terms, and digital platforms increasing awareness, these loans cater to those without traditional banking options, providing a powerful tool for short-term financial stability.

San Antonio residents now have more options for accessing quick cash through innovative financial services, with a notable rise in San Antonio title loans. This growing trend offers an alternative to traditional lending methods. Our comprehensive guide explores the expanding landscape of San Antonio title loans, providing insights into how these loans work and empowering readers to make informed decisions. From understanding the benefits to navigating potential pitfalls, this article promises to unlock financial freedom for those seeking flexible solutions in the vibrant city of San Antonio.

- San Antonio Title Loans: Unlocking Financial Freedom

- The Rise of Title Loan Options in San Antonio

- Navigating San Antonio's Title Loan Landscape: A Comprehensive Guide

San Antonio Title Loans: Unlocking Financial Freedom

San Antonio title loans offer a unique opportunity for residents to gain access to immediate financial support and unlock their path to financial freedom. This innovative lending solution is designed to cater to individuals who may not have traditional bank options or face challenges in obtaining credit. By utilizing the equity in their vehicles, San Antonio title loans provide a swift and convenient way to secure funds without the lengthy processes often associated with conventional loans.

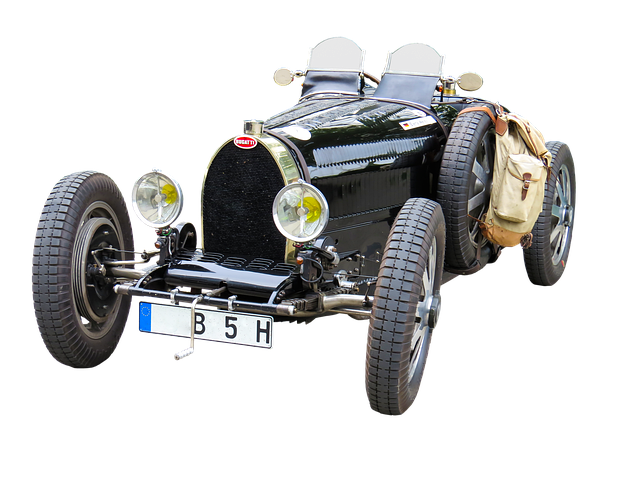

With a focus on customer-centricity, these loans offer flexible repayment options, allowing borrowers to tailor their payments to suit their financial capabilities. The process begins with an assessment of the vehicle’s valuation, ensuring transparency and fairness throughout. Borrowers can also explore loan extension possibilities if needed, providing additional flexibility. San Antonio title loans are a powerful tool for those seeking financial stability and a chance to take control of their monetary future.

The Rise of Title Loan Options in San Antonio

In recent years, San Antonio has witnessed a significant expansion in financial education and access to alternative lending options, with San Antonio title loans emerging as a prominent choice for many residents. This growing trend reflects a changing financial landscape where individuals seek flexible and accessible solutions to meet their short-term cash needs. With the rise of digital platforms and a better understanding of personal finance, borrowers are now more informed about their loan options.

San Antonio title loans, also known as car title loans, offer a quick approval process and have gained popularity due to their flexibility. Borrowers can use their vehicle’s title as collateral, providing a convenient and efficient way to secure funds without the lengthy application processes often associated with traditional loans. This option is particularly appealing for those with poor credit or needing money fast, ensuring that residents of San Antonio have a viable financial tool at their disposal.

Navigating San Antonio's Title Loan Landscape: A Comprehensive Guide

San Antonio’s landscape of financial services is rich with options, particularly when it comes to San Antonio title loans. This comprehensive guide aims to navigate individuals through this diverse market, ensuring they make informed decisions regarding their emergency funding needs. Whether one finds themselves in a bustling neighborhood or nestled in a quiet suburb, understanding the various types of loans available is paramount.

San Antonio title loans offer a unique solution for those seeking same-day funding. These loans are secured against an asset, usually a vehicle’s title, providing quick access to cash. Unlike traditional bank loans, they often have simpler eligibility requirements and faster processing times. This makes them appealing for folks in need of immediate financial assistance, whether it’s for unexpected expenses or bridging short-term gaps. However, it’s crucial to research lenders, compare interest rates, and understand the terms to avoid any surprises.

San Antonio title loans are transforming financial accessibility, offering a unique and swift solution for those seeking capital. As the demand continues to grow, comprehensive guides like this one play a vital role in helping folks navigate this option’s complexities. By understanding the landscape, individuals can make informed decisions, leveraging San Antonio title loans’ potential while maintaining financial responsibility.