New transparency rules in San Antonio reform title loans with clear terms, vehicle inspections, and flexible payment options, empowering borrowers to make informed decisions about emergency funds while fostering trust, responsible borrowing, and setting a national model for ethical consumer-friendly lending practices.

In recent years, San Antonio title loans have entered a new era marked by enhanced transparency rules. These regulatory changes aim to protect consumers and ensure fair lending practices within the industry. This article explores how these transparency rules are reshaping San Antonio title loan contracts, focusing on consumer protection, fair lending, and their broader local and national implications. By examining real-world examples, we highlight the positive shifts these rules bring to borrowers seeking short-term financial solutions.

- San Antonio Title Loans: A New Era of Transparency

- Unlocking Consumer Protection: Rules in Action

- Shaping Fair Lending: Local Impact and Beyond

San Antonio Title Loans: A New Era of Transparency

In San Antonio, the landscape of title loans is undergoing a significant transformation as new transparency rules take effect. These regulations are designed to protect borrowers and ensure they have a clear understanding of the terms and conditions associated with their loans. Previously, many San Antonio title loan transactions lacked this crucial element of transparency, leaving borrowers susceptible to hidden fees and complex repayment structures.

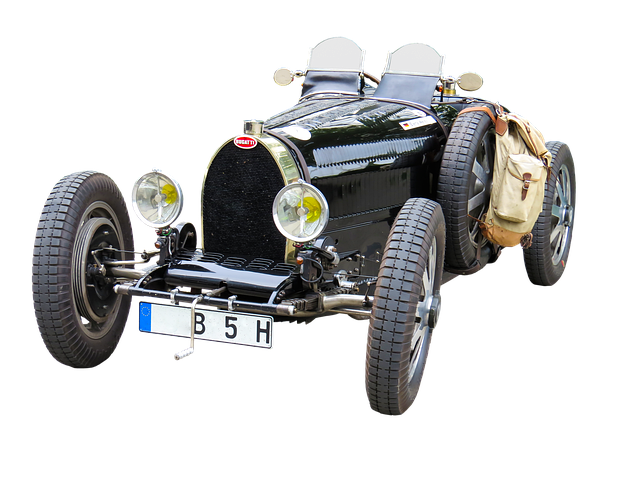

Now, lenders in San Antonio are required to conduct thorough vehicle inspections and provide detailed information on flexible payment options. Borrowers can expect to see a breakdown of all costs, including interest rates, processing fees, and potential penalties for early repayment. This new era of transparency empowers residents to make informed decisions about their financial needs, especially when it comes to accessing emergency funds quickly. By understanding the terms and conditions from the outset, San Antonio title loan borrowers can better manage their repayments and avoid unexpected challenges.

Unlocking Consumer Protection: Rules in Action

The new Transparency Rules have brought about a significant shift in how San Antonio title loans are structured and perceived by consumers. These rules, designed to protect borrowers, ensure that all terms and conditions related to these secured loans are clearly understood from the outset. This consumer-centric approach is transforming the loan landscape in San Antonio, and beyond, by unlocking much-needed protection for individuals seeking financial assistance through alternative means.

For instance, when applying for a San Antonio title loan, borrowers can now expect comprehensive disclosures about interest rates, repayment schedules, and potential fees. This transparency extends to the process of vehicle inspection as well. Unlike some less stringent practices in Fort Worth Loans, where vehicles might be appraised superficially, these rules mandate thorough inspections, ensuring that the collateral is accurately valued. Even types like Truck Title Loans must adhere to these standards, promoting fairness and security for all parties involved.

Shaping Fair Lending: Local Impact and Beyond

In San Antonio, transparency rules have reshaped the landscape of title loans, with a significant focus on ensuring fair lending practices. These regulations are not just a local story; they carry implications far beyond the city limits. By mandating clear and concise terms in contracts for San Antonio loans, borrowers are better equipped to understand their rights and obligations. This shift fosters trust between lenders and borrowers, promoting responsible borrowing and repaying habits.

The impact extends further as models of flexible payments, like tailored payment plans, gain traction. These innovative approaches make San Antonio title loans more accessible and manageable for many individuals, addressing the need for transparency and adaptability in lending. As a result, the city serves as a testament to how local initiatives can drive positive change in the broader financial sector, setting a standard for ethical and consumer-friendly lending practices nationwide.

Transparency rules have significantly reshaped San Antonio title loans contracts, enhancing consumer protection and fostering fair lending practices. These regulations are a game-changer, ensuring that borrowers in San Antonio understand the terms of their loans from the outset. By implementing these changes, local authorities aim to prevent predatory lending and promote financial well-being for all residents. This shift not only benefits San Antonio but also sets a standard for transparent title loan practices across the nation.