San Antonio's title loan market offers quick funding but is subject to regulatory changes aimed at protecting borrowers from predatory practices, especially with growing popularity of Dallas title loans. Recent reforms focus on transparent terms, clear communication about interest rates and penalties, maintaining borrower vehicle ownership, and promoting responsible lending for San Antonio title loans.

San Antonio, known for its rich cultural heritage, is also home to a significant number of residents who rely on alternative financing options. San Antonio title loans have long been a prominent part of the local financial landscape. However, recent regulatory scrutiny is reshaping this industry. This article delves into the evolving regulations affecting San Antonio title loans, exploring their implications for borrowers and lenders alike. By understanding these changes, both parties can navigate the new rules effectively.

- Understanding San Antonio's Title Loan Landscape

- Regulatory Changes and Their Impact on Borrowers

- Navigating New Rules: Lenders' Perspective

Understanding San Antonio's Title Loan Landscape

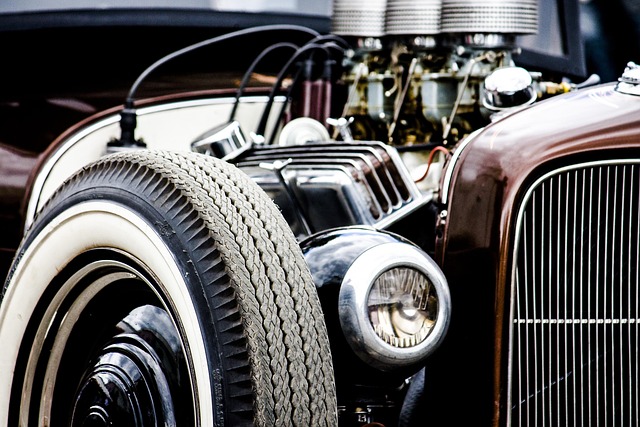

San Antonio’s title loan market is a vibrant yet complex ecosystem where individuals seek quick funding solutions secured by their vehicles. This city, known for its rich cultural heritage and thriving economy, also hosts a diverse range of lenders offering various loan types, including San Antonio title loans. These loans, secured against vehicle titles, provide access to capital for borrowers who might not qualify for traditional bank loans. The market is characterized by both online and physical lenders, each with unique terms and conditions, making it crucial for borrowers to understand their options.

While San Antonio title loans can be a lifeline for many, recent regulatory changes aim to protect borrowers from predatory lending practices. These regulations are especially pertinent in light of the growing popularity of Dallas title loans and other alternative financing methods. Borrowers must be aware of their rights and repayment options, such as keeping their vehicle during the loan period, to ensure a fair and transparent transaction. Understanding these dynamics is essential for making informed decisions in a rapidly evolving financial landscape.

Regulatory Changes and Their Impact on Borrowers

The recent regulatory changes aimed at San Antonio title loans reflect a broader trend to protect borrowers from predatory lending practices. These adjustments are particularly significant for residents seeking short-term financial solutions, such as cash advances or loan payoffs. With new guidelines in place, borrowers can expect more transparent terms and conditions when availing of title loans.

One key impact is the emphasis on maintaining borrower rights while ensuring fair lending standards. Regulations now mandate clear communication about interest rates, repayment schedules, and potential penalties for early loan payoff. This shift empowers San Antonio residents to make informed decisions, avoiding unexpected fees often associated with traditional cash advances. By keeping their vehicles as collateral and understanding the terms, borrowers can secure a reliable source of funding while retaining control over their assets.

Navigating New Rules: Lenders' Perspective

With new regulatory scrutiny on San Antonio title loans, lenders are navigating a shifting landscape. The recent changes aim to protect consumers and ensure fair practices in the short-term lending industry, particularly for popular options like car title loans. These rules impact how lenders operate, emphasizing transparency, clear communication, and responsible lending. Lenders must now provide detailed information about interest rates, repayment terms, and potential fees upfront, giving borrowers a clearer understanding of their financial obligations.

The new regulations also emphasize the importance of maintaining the borrower’s vehicle ownership. While quick funding is a significant advantage of San Antonio title loans, lenders are now required to ensure borrowers have the means to repay without resorting to refinancing or extending the loan repeatedly. This shift balances the need for access to capital with the responsibility to prevent borrowers from falling into cycles of debt.

The recent regulatory scrutiny of San Antonio title loans marks a significant shift in the city’s financial landscape. With new rules in place, both borrowers and lenders must adapt to ensure fair practices and accessible credit options. As the industry navigates these changes, it’s crucial to maintain transparency, educate consumers, and foster a balanced environment for San Antonio residents seeking short-term financial solutions.