San Antonio residents facing urgent financial needs have increasingly turned to San Antonio title loans as a quick and convenient solution, despite recent policy changes that have altered the market. These loans, secured by vehicle collateral, offer swift approval (within hours) and are suitable for unexpected expenses or debt consolidation. However, evolving regulations now emphasize consumer protection, responsible lending practices, and clear borrower obligations, including vehicle inspections and appraisal as collateral. Refinancing options further enhance flexibility, ensuring a more sustainable borrowing experience in the San Antonio title loans sector.

“San Antonio title loans have long been a financial option for residents facing immediate cash needs. However, recent policy changes are reshaping the availability and terms of these short-term loans. This article delves into the evolving landscape of San Antonio title loans, exploring how regulatory shifts impact their accessibility. We’ll guide borrowers through this new era, offering insights into what to expect when considering a title loan in San Antonio, ensuring informed decisions in today’s dynamic financial market.”

- Understanding San Antonio Title Loans: A Brief Overview

- Impact of Policy Changes on Title Loan Availability

- Navigating the New Landscape: What Borrowers Need to Know

Understanding San Antonio Title Loans: A Brief Overview

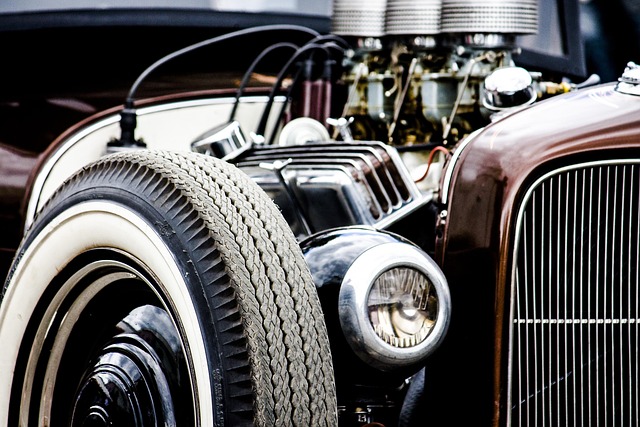

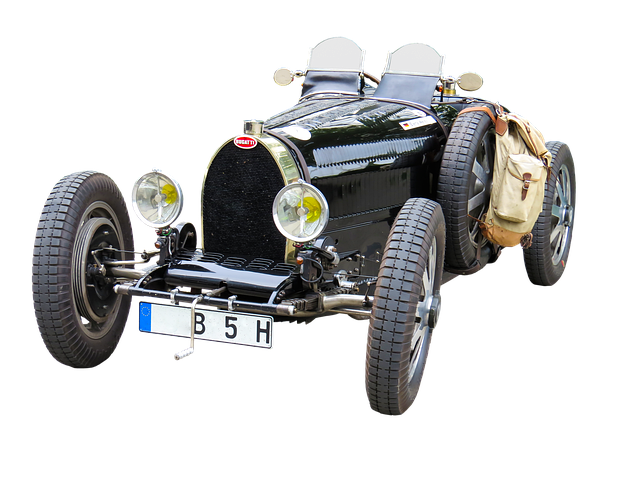

In the vibrant city of San Antonio, Texas, access to quick financial solutions is a significant aspect of residents’ lives. San Antonio title loans have emerged as a popular choice for those seeking short-term funding, offering a unique and efficient way to borrow against one’s asset—their vehicle’s title. This type of loan provides a convenient alternative to traditional banking options, especially for individuals with limited credit history or immediate financial needs. The process involves using the car’s registration and title as collateral, ensuring a swift approval and access to cash in a matter of hours.

These loans are tailored to cater to various financial scenarios, from covering unexpected expenses to facilitating debt consolidation—a strategy where borrowers can combine multiple debts into one manageable payment, including San Antonio title loans or even Houston Title Loans, Boat Title Loans, among others. By utilizing their vehicle’s equity, San Antonio residents can access funds without the extensive waiting periods and stringent requirements often associated with traditional loans, making it an attractive option for many in need of immediate financial assistance.

Impact of Policy Changes on Title Loan Availability

In recent years, policy changes have had a significant impact on the availability of San Antonio title loans. These regulations, aimed at protecting consumers and promoting fair lending practices, have altered the landscape for both lenders and borrowers. One direct result is that some institutions may no longer offer these types of loans, while others have adapted to meet new standards, such as requiring direct deposit and stringent verification processes. This shift has made it crucial for San Antonio residents in need of quick cash to understand the evolving market.

Furthermore, policy changes often reflect a focus on managing interest rates and ensuring borrowers can repay their loans without falling into debt traps. Lenders are now expected to disclose terms clearly, including interest rate structures and potential fees, allowing consumers to make informed decisions based on their financial capabilities. The use of vehicle equity as collateral has also changed, with new policies encouraging responsible lending and preventing predatory practices.

Navigating the New Landscape: What Borrowers Need to Know

In light of recent policy changes, borrowers seeking San Antonio title loans find themselves navigating a new landscape. These adjustments have streamlined access to cash advances for some but also come with heightened regulations. Borrowers must now be more informed about their rights and obligations. One key aspect is understanding that while these loans offer speed and flexibility, they typically require a vehicle inspection and appraisal as collateral.

The process has evolved, offering options like loan refinancing for those who find themselves unable to repay initially. This allows borrowers to adjust terms, potentially lowering monthly payments and extending the loan period. Such developments aim to protect both lenders and borrowers, ensuring a more sustainable borrowing experience within the San Antonio title loans sector.

The recent policy changes have significantly reshaped the availability of San Antonio title loans, impacting both lenders and borrowers. Understanding these shifts is crucial for navigating this new landscape. Borrowers should be informed about the stricter regulations, alternative financing options, and enhanced borrower protections now in place. By staying updated on these developments, individuals can make more informed decisions regarding their financial needs, ensuring they access legitimate and fair San Antonio title loan services.