San Antonio's title loan industry offers quick cash through secured loans backed by vehicles, with both physical and online lenders operating under separate regulations. Loan terms vary widely, and while online applications make it accessible, responsible borrowing is crucial due to potential predatory practices. The market faces licensing and regulation issues, leading to high-interest rates and aggressive collection tactics. However, regulatory reforms aim to simplify rules, protect consumers, and enhance transparency in the San Antonio title loans sector, addressing a national trend to mitigate subprime risks.

San Antonio’s title loan industry, once a thriving sector, now navigates complex licensing challenges. This article delves into the evolving landscape of San Antonio title loans, exploring licensing loopholes that have plagued the market and their significant impact on borrowers. We examine regulatory reforms aimed at promoting fair lending practices, providing insights into how these changes are shaping the future of the industry. Understanding these dynamics is crucial for both consumers and lenders in the rapidly transforming San Antonio title loan market.

- Understanding San Antonio's Title Loan Landscape

- Licensing Loopholes and Their Impact

- Navigating Regulatory Reforms for Fair Lending

Understanding San Antonio's Title Loan Landscape

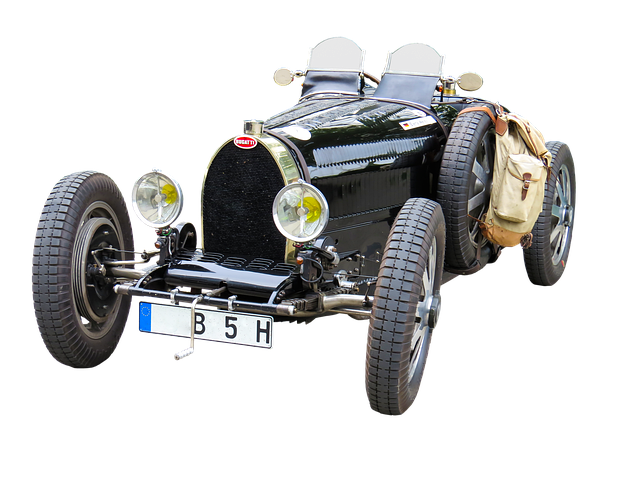

San Antonio’s title loan industry is a significant sector within the city’s financial services landscape. These loans, secured by the borrower’s vehicle, have become an attractive option for many residents seeking quick cash. The market is diverse, comprising both traditional brick-and-mortar stores and online lenders, each operating under distinct regulations. Understanding this dynamic environment involves recognizing the varying loan terms offered by these providers, which can range from short-term, high-interest options to longer-term alternatives with potentially more favorable conditions.

The process typically begins with a simple online application, where potential borrowers input their personal and vehicle information. This digital approach has democratized access to capital, enabling San Antonio residents to explore loan approval possibilities without extensive documentation or in-person visits. However, it also underscores the importance of responsible borrowing, as online platforms can sometimes be exploited for predatory lending practices. Therefore, consumers must remain vigilant and thoroughly research lenders before committing to any San Antonio title loans.

Licensing Loopholes and Their Impact

The San Antonio title loans industry has long faced challenges related to licensing and regulation, with one of the primary issues being loopholes that allow for lax oversight. These loopholes have significant implications, enabling some lenders to offer subprime financial services without proper scrutiny. As a result, borrowers in San Antonio may find themselves at risk of falling into cycles of debt through high-interest rates, opaque terms, and aggressive collection practices.

This lack of stringent licensing also hinders consumers seeking legitimate debt consolidation or secured loans options, as the market becomes saturated with less reputable providers. While “no credit check” promotions might seem appealing, they often mask predatory lending practices, further complicating an already challenging financial situation. Borrowers must be vigilant and well-informed to navigate this landscape effectively, ensuring they access responsible and transparent San Antonio title loans services.

Navigating Regulatory Reforms for Fair Lending

The San Antonio title loans industry has been undergoing significant regulatory reforms aimed at ensuring fair lending practices. These changes are pivotal in protecting consumers from predatory lending and ensuring transparency in the loan approval process. With a focus on simplifying regulations, regulators are making strides to level the playing field for both lenders and borrowers. This involves clear guidelines on interest rates, terms, and conditions, enabling borrowers to make informed decisions when securing San Antonio title loans.

The move towards fair lending reforms is not just about San Antonio; it reflects a broader trend across the nation, particularly in states with high demand for alternative financing options like Houston title loans and car title loans. By implementing these changes, regulators hope to foster a more inclusive financial environment, offering accessible and affordable credit opportunities to all, while mitigating the risks associated with subprime lending.

The San Antonio title loans industry, once characterized by loose licensing regulations, is now facing a critical juncture. By understanding the landscape and loopholes that have historically enabled predatory lending practices, city officials can implement regulatory reforms that promote fair lending. Moving forward, these changes will not only protect consumers but also ensure the long-term sustainability of the San Antonio title loans sector.